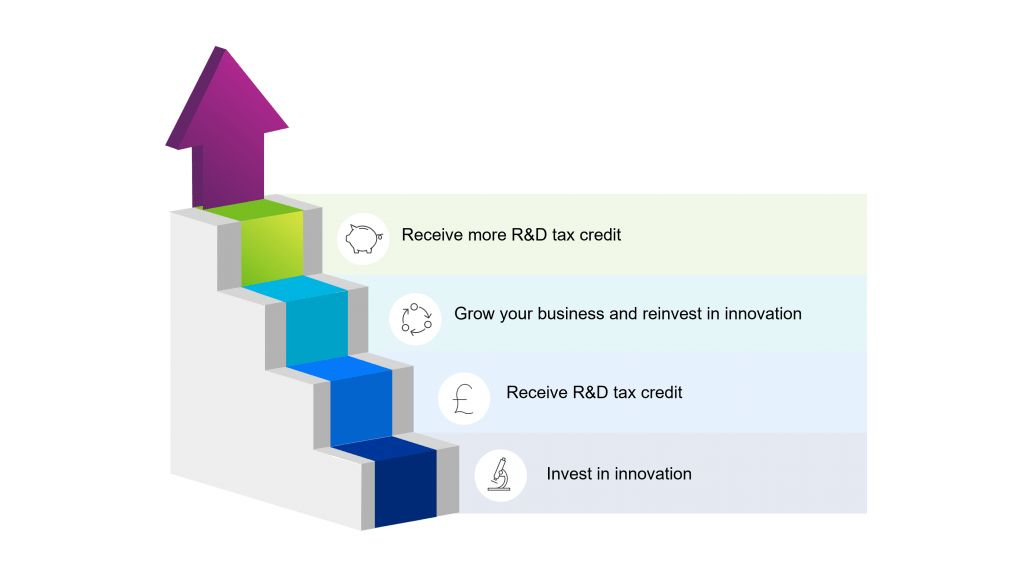

Fuel innovation and fund growth in your business with R&D tax incentives.

With UK businesses that innovate growing at around twice the rate of those that do not, investment in research and development (R&D) is vital for future success. Our R&D tax specialists can help you claim relief to support your current projects and finance future ones.

What is R&D?

Research and development (R&D) refers to work carried out by a business to develop new products, processes or services and improve existing ones. Far from being confined to scientists and laboratories, R&D is taking place every day in businesses just like yours. It spans a wide range of industries and projects – what all these projects have in common is they are born from the desire to innovate.

Benefits of R&D tax incentives

R&D tax credits and Research and Development Allowances (RDA) are government schemes that aim to incentivise innovation in SMEs and large companies across the UK.

Whatever your corporate objectives, your business could benefit significantly from R&D tax incentives. A successful claim can provide you with substantial cash savings, which could be used to relieve cash-flow pressures, pay off tax bills or support future R&D to grow your business.

Common qualifying costs

-

Capital expenditure*

Costs associated with acquiring or maintaining fixed assets for an R&D project may be eligible for R&D allowances.

-

Software costs

Computer science and IT advancements, such as AI, cloud computing and data processing technology, may be eligible.

-

Materials used during the R&D process

This could include energy costs, materials used in testing or prototype construction costs.

-

Staff costs

This could include staff employment costs (salary, pension and NI contributions) as well as staff-related project costs, for example training and administration.

-

Subcontractor costs

The cost of hiring workers that you do not directly employ for R&D projects qualifies for a reduced rate of 65%.

-

*Capital expenditure is only relevant for RDAs

R&D tax incentives for SMEs

You can claim up to 186% (100% deduction + 86% enhanced R&D deduction) tax relief on qualifying expenditure if you own a profit-making SME.

If your company makes a loss for tax purposes, you can surrender the loss generated from R&D expenditure for a payable 10% tax credit. However, if your company spends more than 40% of all expenditure on eligible R&D costs, the payable tax credit is then 14.5%.

R&D tax incentives for large companies

If your company is not an SME, then you can make a claim under the RDEC scheme. This provides a credit of 20% based on your eligible expenditure. This is an ‘above-the-line’ credit so the net benefit after corporation tax would be between 15% and 16.2%.

Are you eligible for R&D tax credits?

Despite the financial gains available, many business owners do not realise they are eligible to claim R&D tax credits. If you fit the criteria below, you may qualify for tax relief and should speak to an R&D tax expert for more advice.

- You own a limited company that is registered in the UK

- You are developing or improving a product, process or service

- Your R&D project must have attempted to overcome uncertainty and make an advance in science and technology

- Your project involves an issue that could not be easily worked out by another expert in your field

Even if your project was ultimately unsuccessful, you may still be able to claim.

View our R&D guide

Your claim – a step-by-step process

Our corporate tax team possesses specialist knowledge and expertise in R&D to guide you through the claims process. From evaluating your eligibility to managing your application, we can significantly increase your chances of a successful claim.

As we tailor our services to your needs, the claims process can vary from business to business, but a typical process will follow the steps below:

1. Your initial consultation and eligibility assessment

We meet with you and your team to find out what you need from us. After this meeting, we should be able to tell you whether your project will be eligible for R&D tax incentives and if a claim is likely to be successful.

2. A thorough evaluation

Once we have established your project is eligible, we will examine your R&D activities more thoroughly. We will also explore opportunities to maximise the value of returns on your claim by considering the finer details of your project.

3. Preparing your claim

We take care of the whole claims process, giving you more capacity to focus on your business. This will involve gathering evidence on R&D activities and costs to support your claim and preparing documentation for HMRC. This collaborative process will require time from you and members of your team, but we minimise your time involvement where possible.

4. Submitting your claim

We will submit your claim to HMRC on your behalf. This includes submission of the corporation tax return, our R&D report and HMRC’s new additional information form.

5. Reviewing and processing your claim

HMRC will review your claim and decide whether it is eligible. It is possible that HMRC may raise an enquiry at this stage to request additional evidence, which we will handle for you.

6. Receiving your R&D relief

Once HMRC has approved your claim, you will receive your relief in the form of reduced corporation tax or cash payment.

Navigating HMRC in the current climate

Ongoing changes to taxes, allowances and HMRC services are making it increasingly challenging for business owners to access the support they are entitled to. As a result, dealing with HMRC can become a frustrating and long-winded process.

HMRC has also increased their scrutiny of R&D claims, raising more enquiries into whether company’s projects meet the eligibility criteria.

Our R&D specialists and corporate tax team have extensive experience in liaising with the UK tax authority. We can handle HMRC on your behalf, saving you time and stress in the process.

Reduce costs and increase growth with specialist guidance on R&D tax incentives

We want to help you gain the relief you are entitled to and save money on your corporation tax. If you are exploring new opportunities for innovation or a potential R&D project is already underway at your company, get in touch with us today to discuss an R&D claim with one of our experts.