Accounting services focus on strategy and compliance adherence for owner-managed businesses. These services are split into two core types of accounting: management accounting and forensic accounting.

The former consists of collating statistical and financial data for trend analysis purposes. Valuable company insights are generated, informing day-to-day functionality and future business decisions, as well as identifying potential areas for growth. Forensic accounting, on the other hand, is the investigation of potentially fraudulent activity and misrepresentation via the application of analytical and investigative methods. Any evidence gathered during this service is then collated and shared with lawyers and other relevant personnel.

Brit Plant Direct

Industry experts in service, quality, and value, Brit Plant Direct are a multi-skilled, nationwide company that provide quality supplies and equipment to businesses in the power generation industry.

Despite being industry leaders with a healthy turnover, future expansion of the business was being scuppered by antiquated manual accounting systems. If left unchecked, the financial uncertainty, incomplete or incorrect data collected, and lack of goal progression could cause a business to stagnate and fold – even if it’s performing well overall.

Martin Gadsby

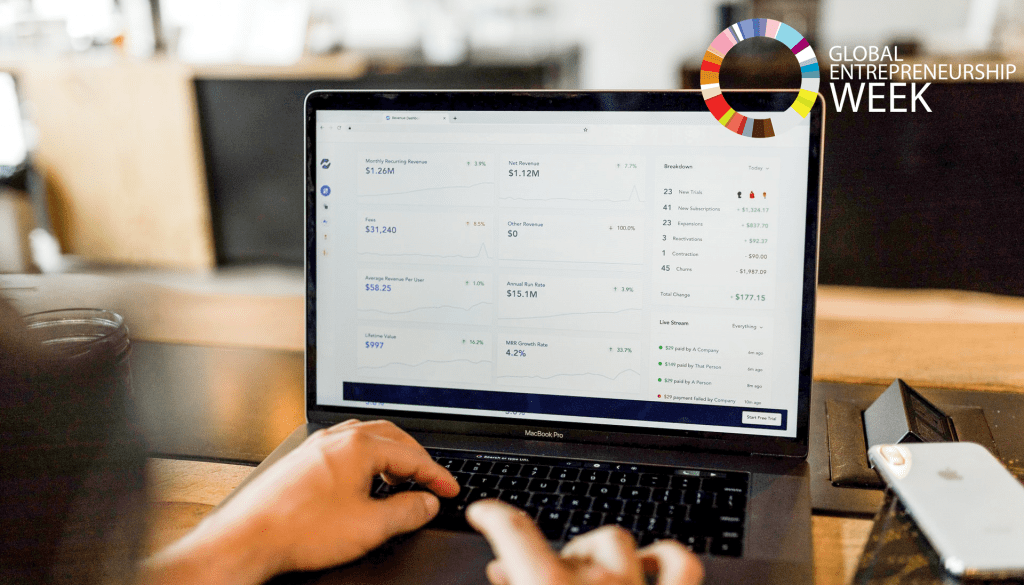

Fraught with imprecise data regarding finances and goal progress, the paper-based accounting system employed by Brit Plant was unfit for purpose and rendered them ill-equipped for the increasing digitisation of business – particularly in the face of upcoming Making Tax Digital (MTD) legislation and GDPR regulations. So, when PKF Smith Cooper got involved with the blossoming business, they helped to ensure future success by overhauling their entire accounting system, transferring them instead to specialist software solution, Xero and Receipt Bank.

This brought the company up to speed with current best practice, creating an intuitive system to manage everything from invoicing, payroll, and bookkeeping to bank reconciliations and streamlining time-consuming admin. Directors and managers were then freed up to identify operating issues, address risks, and manage financial performance, whilst spotting growth opportunities.

How PKF Smith Cooper can help you

Whether you’re a budding entrepreneur embarking upon your first business venture or a seasoned veteran looking to jump feet-first into a digital future, PKF Smith Cooper have got your back.

Our specialist accounting team – who can help with statutory accounts, corporation tax, start-ups, bookkeeping, and business forecasting – can provide valuable insights via trend analysis and bespoke management accounts solutions to help you achieve growth and financial control.

To see how we can help, or to find out a little bit more about the services we offer, get in touch today.