Once a driving factor in the British economy, the UK government has turned to freeports again to level up enterprise in local communities. In the first instalment of our Freeport Reports series, our tax experts introduce freeports by providing an overview of what they are, where they are located and how businesses like yours in the East Midlands can benefit from crucial tax and customs incentives.

The UK was once home to several operational freeports until their leases were not renewed in 2012.

Today, freeports are back at the heart of the UK’s plans for boosting trade, creating jobs and driving investment and innovation across the country. The reintroduction of a transformed freeports scheme is an integral part of the government’s regional ‘levelling up’ agenda, which aims to reinvigorate trade in struggling local communities.

In March 2021, the East Midlands Freeport (EMF) was unveiled by the UK government following a thorough bidding process. Subsequently, on Thursday 30th March, the East Midlands Freeport (EMF) was granted formal permission to start operating.

As a potential driving force for business growth in the East Midlands, we answer some of the questions you may have about freeports and look at the benefits they can offer your business, including significant tax incentives and improved customs measures.

What are freeports and how do they work?

Freeports are designated areas within a country where goods can be imported, processed and stored without being subjected to standard customs measures. The aim of a freeport is to drive trade, promote jobs and encourage economic growth within a respective region.

Due to the restored focus on freeports in recent years, many people mistakenly believe that the freeport model is a new concept. Freeports were actually first introduced in the UK by Margaret Thatcher in the 1980s to battle de-industrialisation and a failing economy.

The UK freeport model involves primary ‘customs sites’ being plotted out within a freeport in which improved customs benefits will apply. Designated ‘tax sites’ are also allocated where enhanced tax incentives will be available to your business.

The new UK freeports intend to attract global and domestic trade by offering significant tax reliefs and streamlined procedures for imports and exports to businesses operating within their borders. When your business is in the early stages of developing new ideas, freeports could provide access to initial funding from central government (through seed capital) to support further investment in innovation and infrastructure.

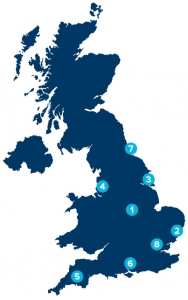

Where are the new freeports in the UK?

Overlapping three counties in the East Midlands region, East Midlands Freeport is made up of three main sites:

- The East Midlands Airport and Gateway Industrial Cluster (EMAGIC) in Northwest Leicestershire

- The Ratcliffe-on-Soar Power Station site in Rushcliffe, Nottinghamshire

- The East Midlands Intermodal Park (EMIP) in South Derbyshire.

There are currently seven other freeports across England. These include:

The two Green Scottish freeports are:

The two Welsh freeports include:

What are the benefits of freeports for your business?

Following an extended period of economic instability, the government aims to use UK freeports to reinvigorate the economy and facilitate enterprise. The plan is to do this by creating investment hotspots and hubs for international trade within the UK.

As the UK’s only inland freeport and home of the UK’s busiest pure cargo airport, East Midlands Freeport has exceptional access to rail, air and road links, making it a prime location to capitalise on commercial and industrial strong points within the region.

Here is a breakdown of some of the benefits freeports could bring your business:

Tax incentives

UK freeports provide your company with greater tax incentives if you are located within their borders. These tax reliefs are designed to encourage you to relocate your operations to a freeport zone so you can grow and invest.

If eligible, your business could benefit from a comprehensive tax relief offering that includes:

- Stamp Duty Land Tax relief

- Enhanced capital allowances for investment in plant and machinery and structures and buildings

- Business rates relief

- Employer National Insurance contributions relief

Customs and tariff benefits

Should your business operate within the boundaries of a freeport customs site, you will be able to take advantage of simplified customs procedures, allowing imports to be processed more easily by reducing the documentation required. In addition, import duties and tariff payments are deferred, or in some cases avoided entirely, until your goods enter the UK market.

Job creation

Freeports may generate job opportunities within your workforce as investment and economic activity in the region grows. Job creation can result from an increase in trade, manufacturing and the development of industries and services within a freeport region.

Innovation and Infrastructure

You will benefit from direct access to relevant regulators through a Freeport Regulation Engagement Network if your business is based in a Freeport. This helps you to navigate regulation as you develop new products and technologies and encourage better discussions between your business and its regulatory bodies. Making early engagements with regulators will help to minimise bureaucracy and uncertainty for your company.

Capitalise on the freeport incentives in the East Midlands today

Is your business currently located within the East Midlands Freeport zone or are you planning to relocate? Our Midlands-based multi-disciplined tax team at PKF Smith Cooper can help ensure your business maximises the potential benefits available to your business.

To find out more about freeports and the potential impact they can have on your business, get in touch with us today. Our specialist tax advisory team will provide tailored guidance to help your business grow.