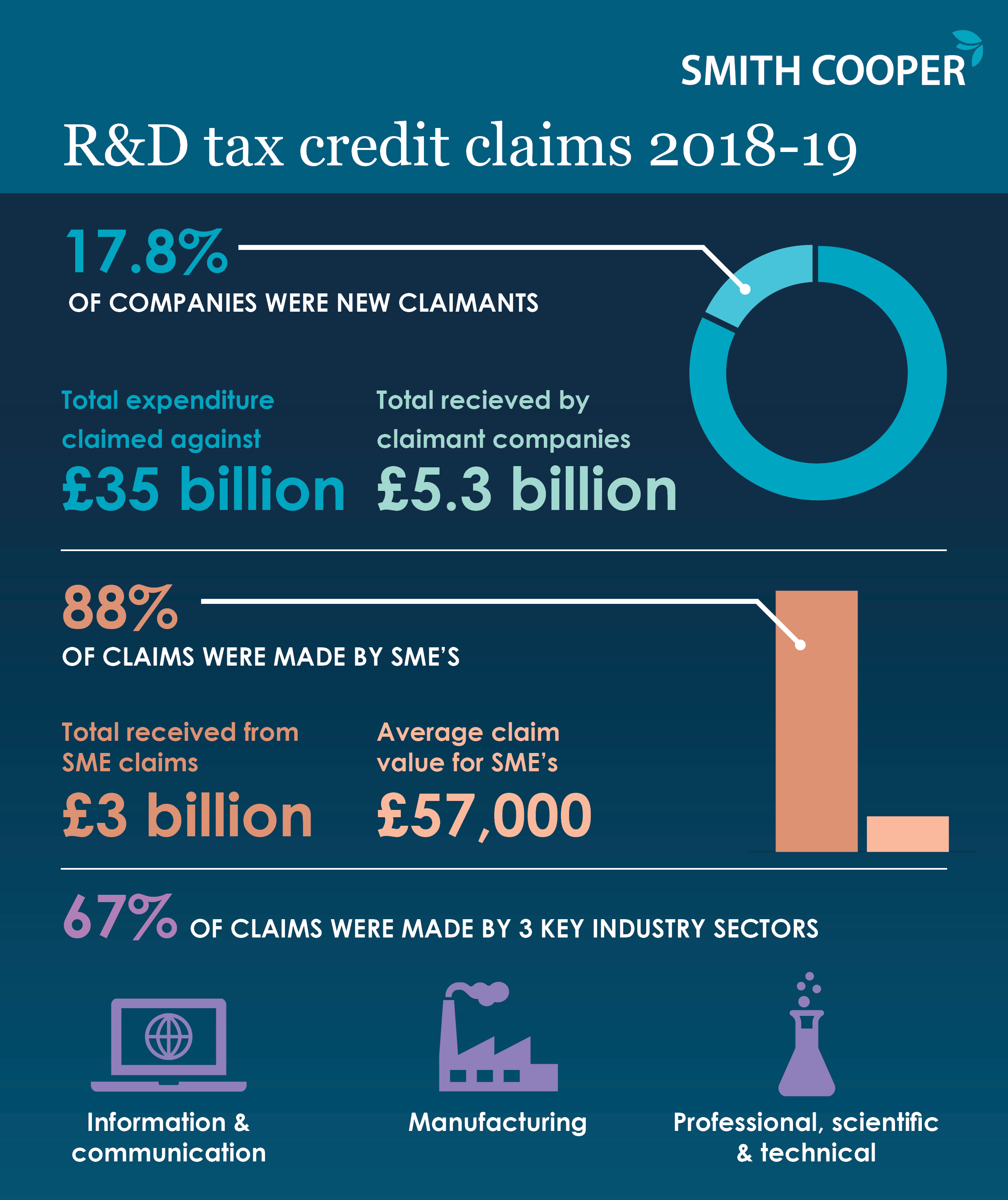

HMRC’s latest statistics for R&D tax claims show that 57,335* companies across the UK have claimed for the 2018-19 year so far, 10,200, or 17.8% of which were new claimants.

| Company Size | 2018-19 | 2017-18 | 2016-17 |

| SME | 8920 | 13935 | 12350 |

| Large Company | 1280 | 1810 | 1905 |

| TOTAL NEW CLAIMANTS | 10200 | 15750 | 14255 |

*As with previous years, the number of new claimants is expected to grow as more claims are made. HMRC anticipate that the total will reflect the trend of growth from previous years.

The wider statistics

A total of over £35 billion in R&D expenditure has been claimed against, resulting in over £5.3 billion in R&D Tax Relief being received by the 57,335 claimant companies.

59,265 claims have been made and this total includes those for companies with more than one accounting period in a single financial year, in addition to SME’s that have submitted a claim for both the SME and RDEC Schemes – hence the number of claims exceed the number of claimant companies.

SME Scheme claims for the 2018-19 financial year account for 88% of the claims made – securing £3 billion in tax relief for SME’s, with the average claim value being £57,000.

In addition, the RDEC Scheme has provided in excess of £2 billion in tax relief for large companies with an average claim value of £632,000.

The statistics show that 3 key industry sectors made 67% of R&D Tax Credit claims for 2018-19 – namely, ‘Manufacturing’, ‘Information & Communication’ and ‘Professional, Scientific & Technical’. These sectors have claimed 71% of the total tax relief.

While the full statistics for the year cannot be finalised until the 2-year retrospective claim period ends, HMRC estimates that the final total of R&D Tax Relief for 2018-19 will be £6.3 billion, once all claims have been processed.

Gary Devonshire, Tax Director and R&D tax specialist comments:

“It is pleasing to see so many companies taking advantage of the scheme, however there are many who aren’t yet, and many of these companies may be eligible. R&D is often underclaimed meaning many companies may be missing out on this valuable relief. At Smith Cooper, we can help identify whether you are eligible and support you through the entire process.”

Sam Stephens, Director at TBAT said

“The 10,200 businesses claiming R&D Tax Credits for the first time is incredibly encouraging, both for us as R&D Tax Specialists, and for businesses that are yet to make a claim. It’s important that through our Partnership, we continue to help businesses realise their eligibility to claim R&D Tax and encourage them to take advantage of these hugely beneficial schemes.”

How we can help

Through the Smith Cooper and TBAT Innovation Partnership, you are guaranteed to get the best advice and support from both accountants and R&D Tax Specialists, to ensure your R&D tax claim is calculated correctly.

Our collaborative approach will account for all your eligible R&D and exclude the right amount for the time your employees spent furloughed, resulting in a robust, evidenced and maximised R&D Tax claim.

If you think your company may be undertaking R&D, our R&D online portal, allows you to submit key data to work out whether you may be eligible to submit a claim, making the whole process quicker, easier and much more accessible. Alternatively, if you have any questions regarding eligibility for R&D tax relief, please get in touch with our specialist tax team.

*Statistics taken from Corporate tax: Research and Development Tax Credits published on 30th September 2020.