PKF gained market share in deal activity as we ranked 5th most active in the Midlands and 7th nationally. Our team once again delivered a high level of M&A activity, against an uncertain economic and political backdrop.

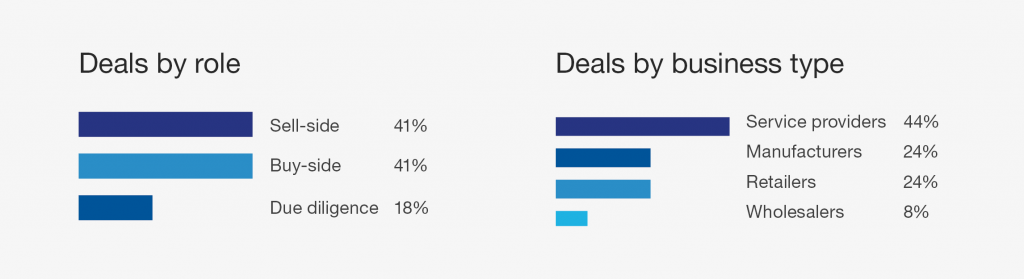

We pride ourselves on deal creation rather than simply executing transactions. In 2023 PKFSC Corporate Finance completed 22 deals worth a combined total of £277m in what has been a challenging market. Our high completion rate reflects the time and effort we put into identifying the right deals for clients and finding creative solutions when issues arise.

Key highlights of the year include:

- Finding the right home for 9 businesses by selling to strategic acquirers;

- Facilitating 4 Management Buyouts;

- Providing acquisition support including private equity bolt on acquisitions;

- Fundraising for a number of our deals;

- Sale to employee ownership trusts; and

- Developing our financial due diligence offering

Over the past year, we have continued to invest and grow our advisory team. Josh Gurton was recognised for his invaluable contribution to deal efforts with a second promotion in six months. We also invested in two new recruits, Callum Leslie and Lauryn Mayson, strengthening our formidable dealmaking team.

We have also been investing in our financial due diligence capabilities with Deniss Sipovics being promoted to manager – a testament to the team’s growing expertise and experience.

Whilst we have international capabilities, we continued to fuel M&A activity on home soil, completing 20 deals in the Midlands and helping business owners across the Midlands achieve their goals and objectives. Drawing on our global reach and access to international purchasers, we completed a number of cross-border deals.

Additionally, our team remain creative and ready to explore a number of potential liquidity events for shareholders. For award-winning technology consultancy Griffiths Waite, an employee ownership trust provided the optimal solution, demonstrating our team’s ability to investigate different options with business owners and identify the best solution to meet their objectives.

The year ended on a high with our Midlands team completing four deals in just two weeks, evidencing that, even in challenging market conditions, the appetite for M&A among high quality businesses remains strong.

Sectors

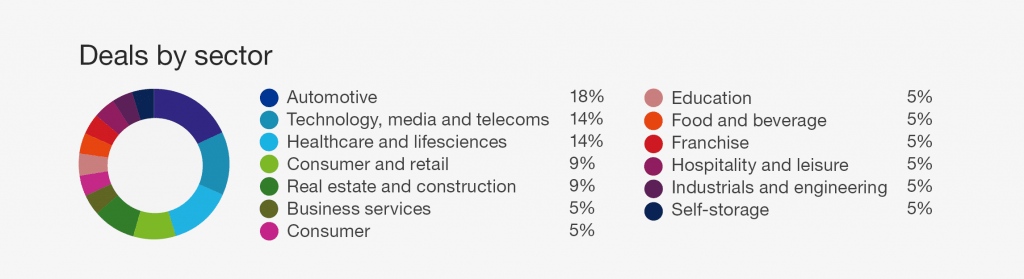

This year our top sectors were Automotive and Technology, Media and Telecoms.

The Automotive sector was strong across the retail, distribution and aftermarket segments. We supported on transactions involving passenger-vehicle and commercial-vehicle dealerships, vehicle hire and rental businesses as well as suppliers and aftermarket services.

In the last 3 years PKF has completed over 100 deals in the broad technology sectors and we continued to build-upon this expertise with transactions in enterprise software, retail-tech and health-tech.

Despite a challenging year for self-storage, which was characterised by tougher trading and instability caused by interest rates and the housing market, we were able to continue to unlock transactions such as Quick Self Storage’s acquisition of Prime Self Storage.

We continued to have deep involvement in the Franchise and Food and Beverage sectors and expect to deliver a number of deals this year.

Outlook for 2024

Could 2024 be the year of the mid-market? Dealmaking levels in the UK are expected to rebound from 2023 levels as uncertainties around inflation, interest rates, as well as political and macro concerns, ease. Despite a more cautious view from corporates and traditional lenders stifling activity, the ingredients underpinning M&A activity remain in place, with alternative funders and increased activity from PE and their portfolio companies supporting the market in 2024.

At PKF Corporate Finance, we anticipate activity in the mid-market to remain robust and we have recruited more personnel to support our anticipated increased deal activity over the coming months. We have exciting plans to expand our team.

If you’d like further information regarding the contents of this document, or you’d like to find out more about how we can help you and your business, please get in touch.

Download publication